Topic/Category

Year

Topic/Category

Year

12 December 2024

Welcome to the December Economic Bulletin. This edition covers key economic data and industry news, including updates on consumer prices, input costs, and commodity trends. We also explore developments in international shipping, energy, labour, retail performance, and consumer confidence.

The fast-moving consumer goods (FMCG) sector is navigating a complex economic landscape shaped by increasing costs, fluctuating prices, shifting market dynamics and both domestic and international political uncertainty.

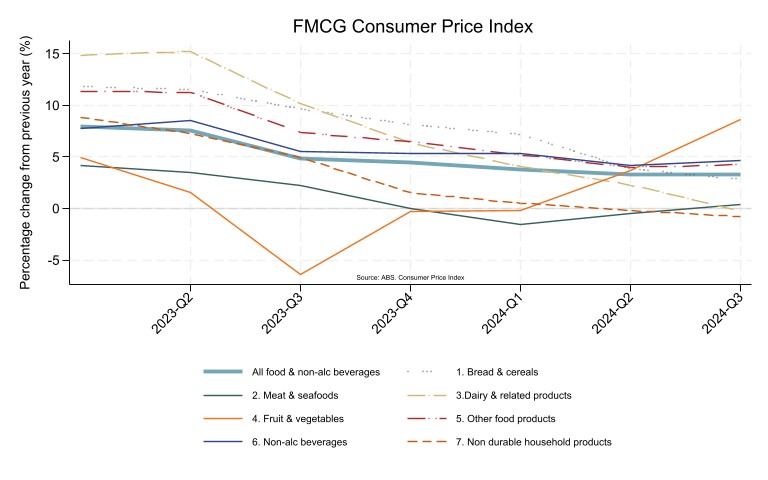

Inflation remains a key issue. Food and non-alcoholic beverage prices rose by 3.3% year-on-year in the September quarter, exceeding headline inflation. While some product categories have seen price drops, essential staples like fruit and oils are nearing double-digit increases. In early December the Reserve Bank of Australia (RBA) released its latest monetary policy statement[1]. The RBA expressed confidence that inflation is easing, though underlying inflation remains above target. Uncertainty around other economic indicators persists. While challenges remain, the likelihood of further rate hikes has decreased, and there is potential of cash rate cuts in 2025, though analysts do not expect this before May 2025.

Consumer confidence is cautiously improving, supported by tax cuts, fiscal relief, and stable interest rates. However, public scrutiny and ongoing government inquiries into the sector add pressure, raising the risk of regulatory action.

Commodity prices present a mixed picture. The FAO food price index dropped by 1.85% year-on-year in the third quarter, reflecting declines in cereals and sugar due to improved supply and weaker demand. Conversely, rising costs in dairy and vegetable oils signal challenges in securing raw materials. Businesses must adopt agile procurement strategies to mitigate these risks.

Supply chain costs are another key pressure point for the sector. Domestic road freight costs rose by 5.5% and warehousing and storage services increased 6.7% year-on-year. International shipping costs, though stabilising month-on-month, remain 184% higher than the same period last year, largely due to disruptions caused by tensions in the Middle East. These pressures demand careful logistics planning and cost management to maintain profitability.

Despite a slight uptick in unemployment, employment expectations are recovering, supported by fiscal measures and stable interest rates. Retail turnover in supermarkets and grocery stores showed modest growth, while online food retailing expanded by 10.7%, signalling opportunities in both traditional and digital channels.

The FMCG sector must navigate these challenges by balancing rising costs, ensuring supply chain resilience, and meeting evolving consumer demands. Strategic planning and adaptability will be crucial for sustaining growth in this evolving landscape.

[1] Statement by the Reserve Bank Board: Monetary Policy Decision | Media Releases | RBA

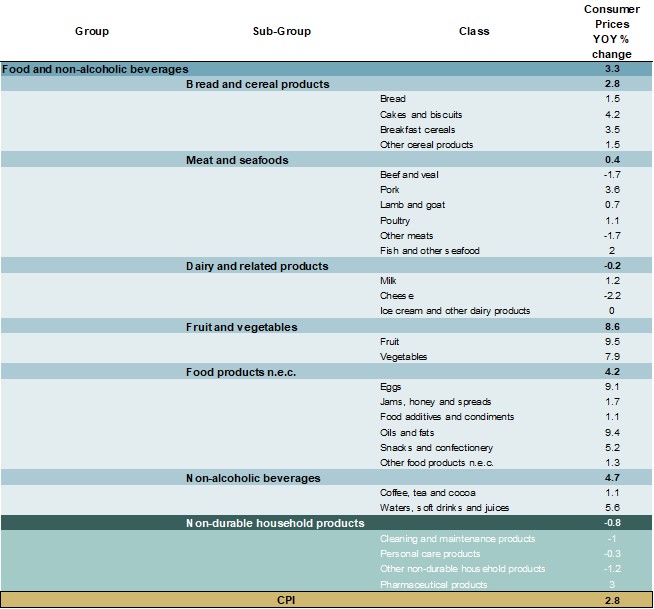

According to the ABS Consumer Price Index data, food and non-alcoholic beverages prices increased by 3.3% over the year to September 2024.

Headline inflation was 2.8% in September 2024.

Key YoY price increases:

Key YoY price decreases:

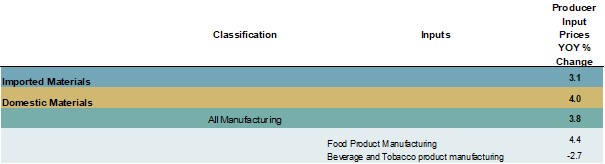

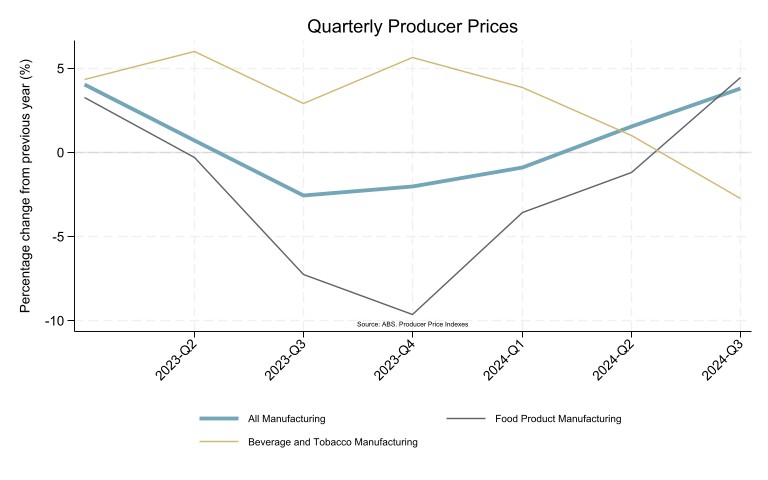

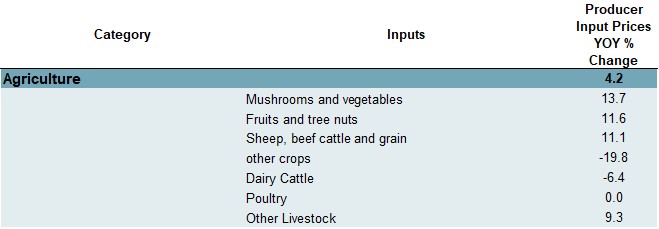

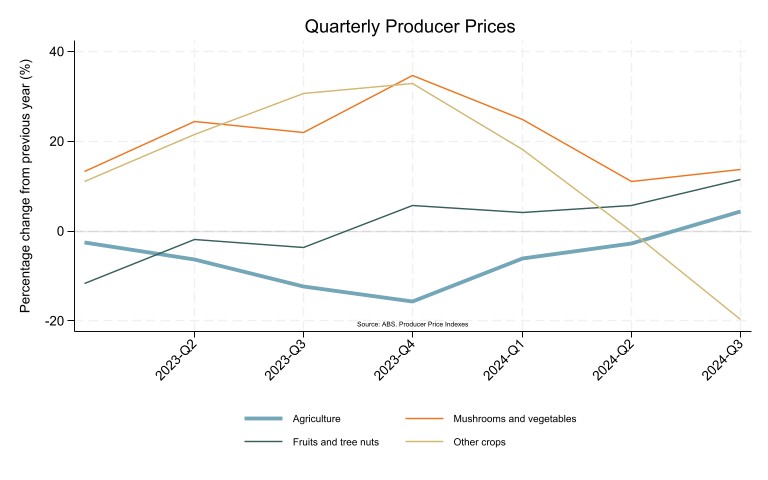

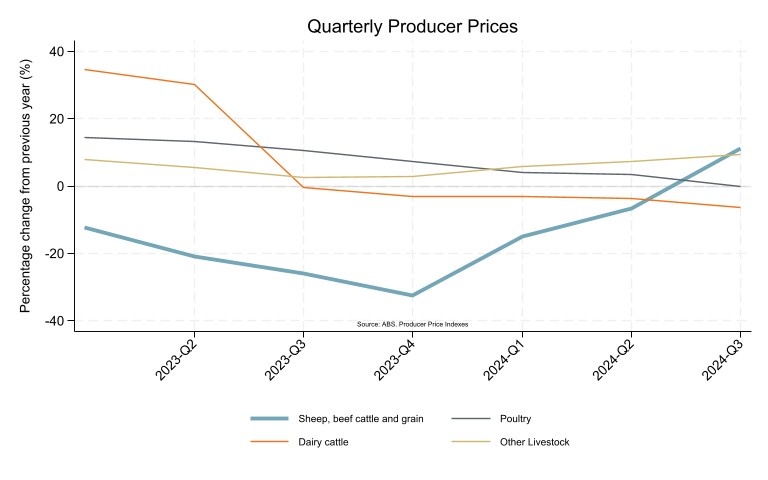

Data from the ABS Producer Price Indexes show that food product input prices rose by 4.4% year-on-year in September 2024.

Beverage and Tobacco inputs dropped% in the same period.

Overall agricultural inputs rose by 4.2% year-on-year in the same period, driven by surging fruit, vegetables and meat costs.

Key categories recording significant year-on-year changes were:

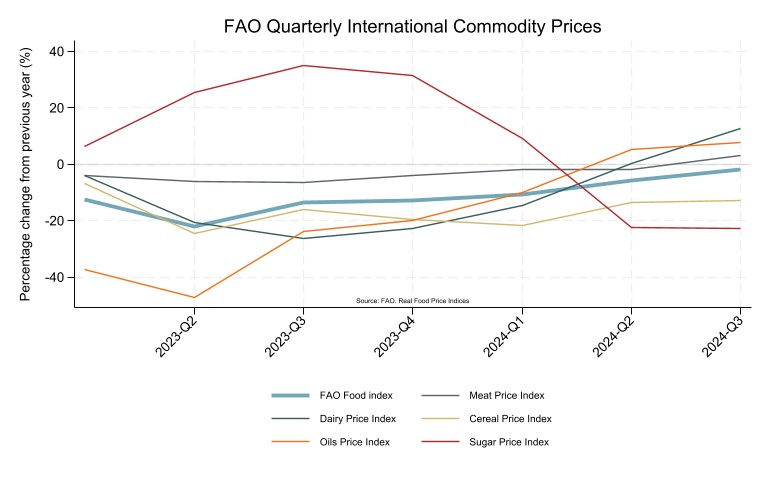

The data below is based on monthly global figures from the UN’s Food and Agriculture Organisation (FAO) to provide a quarterly estimate. The FAO Food Price Index (FFPI) tracks average prices for key food commodities such as cereals, vegetable oils, sugar, meat, and dairy.

In the third quarter of 2024 the FAO’s Food Price Index declined 1.85% year-on-year.

Higher prices for dairy and oils were outweighed by declines in meat, cereals and sugar. Despite this, November’s index reached its highest level since April 2023, reflecting month-on-month recovery.

FAO’s Dairy Price Index rose by 12.5% since September 2023.

Rising prices for milk powders, butter, and cheese due to seasonal production declines in Western Europe, tight inventories, and growing global demand.

FAO’s Cereal Price Index decreased 12.8% since September 2023.

Increased wheat supplies from Southern Hemisphere harvests, improved crop conditions for 2025 in the Northern Hemisphere, and weaker global demand. Declines in barley, sorghum, and rice prices added to the downward trend.

FAO’s Vegetable Oil Price Index has increased 7.9% since September 2023.

In recent months higher prices for palm, rapeseed, soy, and sunflower oils have been fuelled by tight global supplies and robust demand. Concerns about production due to excessive rainfall in Southeast Asia have contributed to the index reaching their highest level since July 2022.

FAO’s Sugar Price Index has declined 22.7% since September 2023.

Lower prices driven by the start of the crushing season in India and Thailand, improved crop prospects in Brazil, and weakening of the Brazilian real.

FAO’s Meat Price Index has increased 3.1% since September 2023.

Declines in pig, poultry, and ovine meat prices were offset by stable bovine meat prices, supported by strong demand for Brazilian exports.

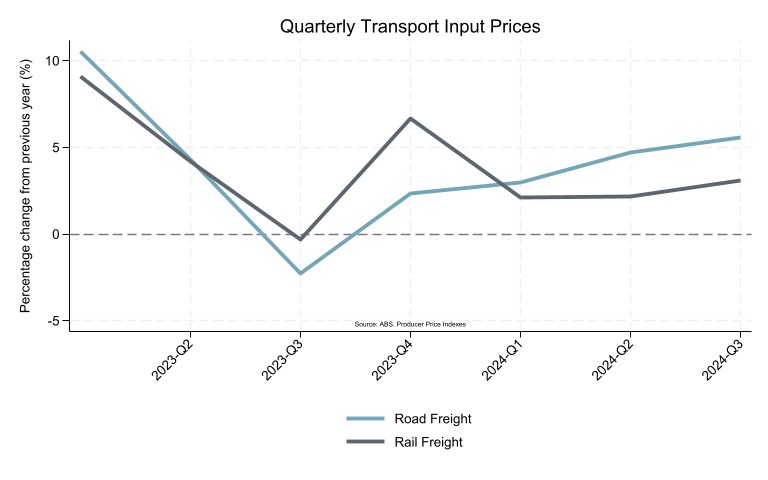

The ABS Producer Price Index shows that domestic road freight costs rose by 5.5% year-on-year in September 2024.

Rail freight costs increased 3.1% in the same period.

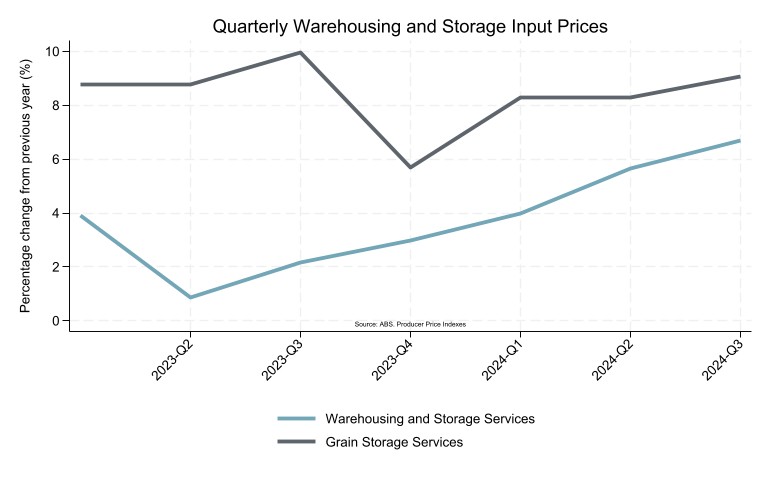

Warehousing and storage services costs recorded a 6.7% year-on-year increase with grain storage services increasing 9.1% in the same period.

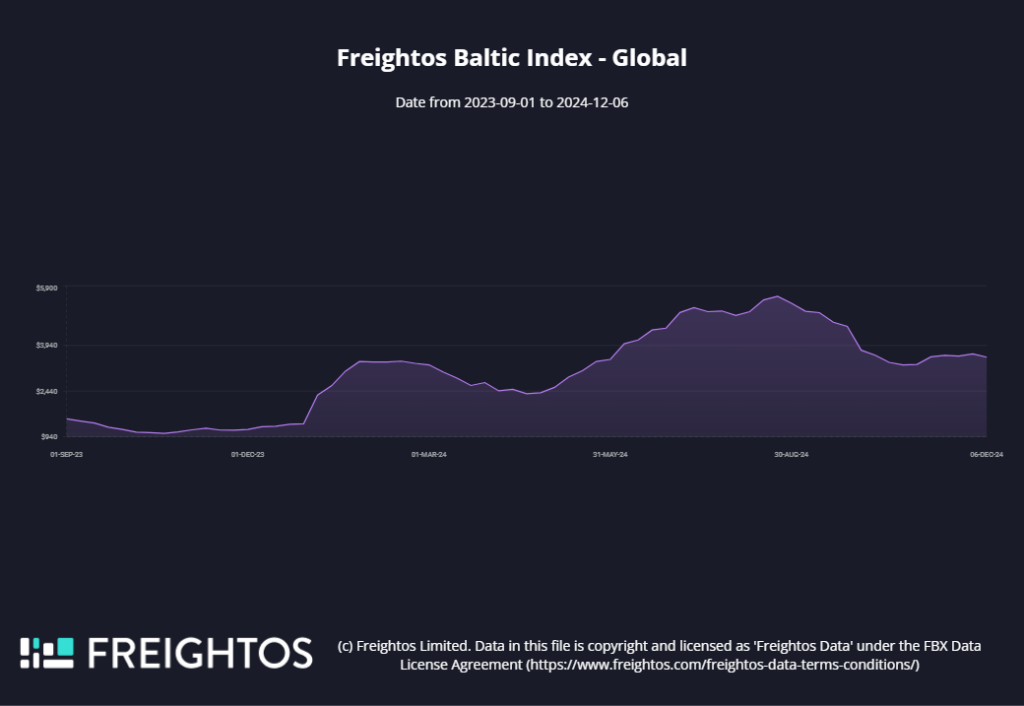

The Freightos Baltic Global Container Index (FBX) shows container freight rates have dropped by 35% since their peak in August 2024. However, shipping costs in November-December 2024 remain 184 per cent higher than the same period last year. This spike is largely due to the red sea attacks earlier in the year, which caused port congestion and disrupted supply chains globally.

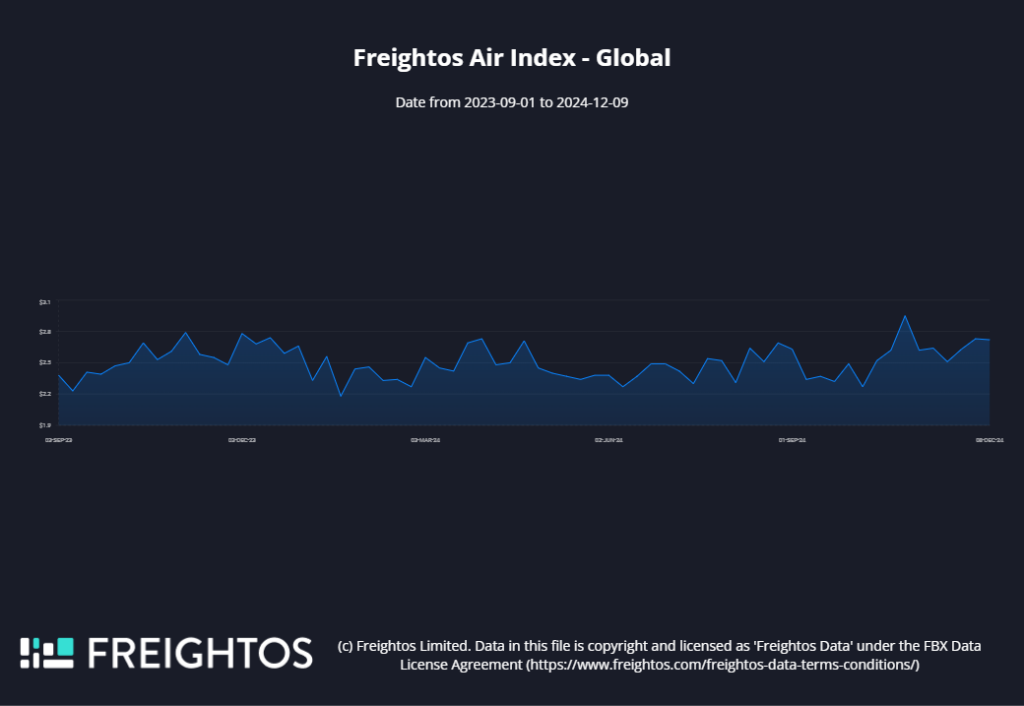

In contrast, the Freightos Air Freight Index (FAX) reports a 7.6%t drop in global air freight costs over the same period.

According to ABS producer price data, natural gas input prices decreased by 4.2% over the 12 months to the September quarter 2024.

Electricity input prices increased 4.7% in the same period.

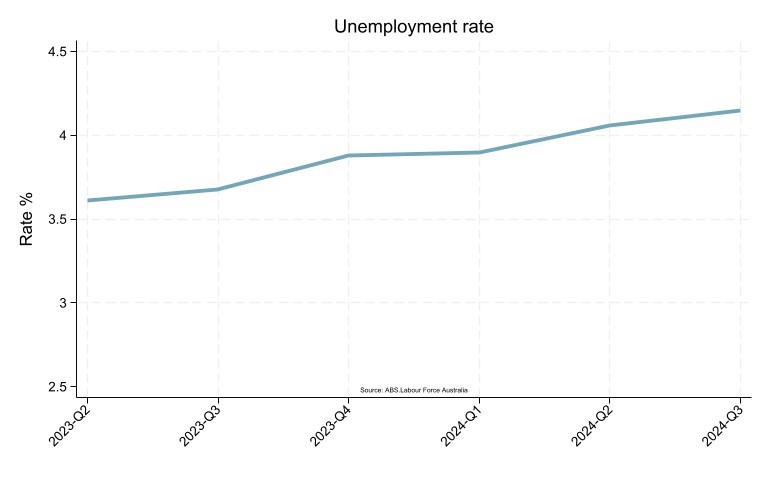

ABS Labour Force Statistics show the average unemployment rate rose to 4.2% in the September quarter. Despite this increase, the labour market remains robust, with the unemployment rate staying at or below 4.2% since early 2022.

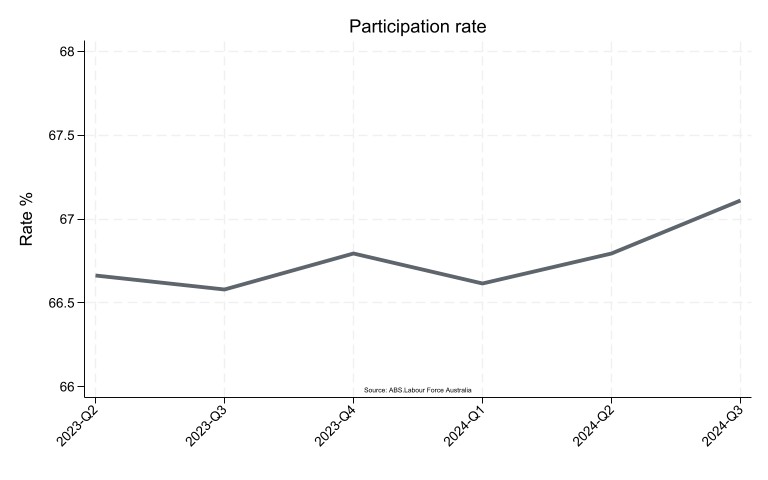

The participation rate edged up slightly to 67.1% in the third quarter of 2024.

Westpac’s Unemployment Expectations Index indicates growing consumer confidence in the labour market, marking the most optimistic outlook since April last year.

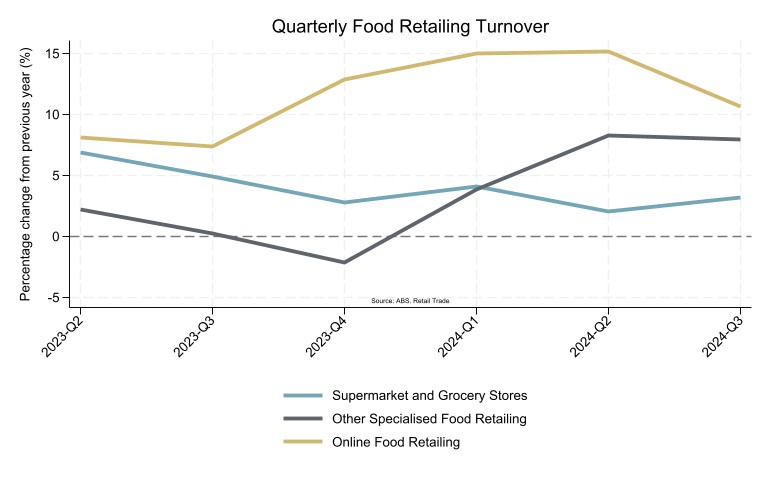

ABS Retail Turnover data shows a 3.2% increase in supermarket and grocery store turnover in the 12 months leading up to the third quarter of 2024.

Other specialised food retailing saw a strong rise, with turnover growing by 7.9% over the same period.

Online food retailing, while slowing from previous quarters, still achieved robust year-on-year growth of 10.7% in the September quarter.

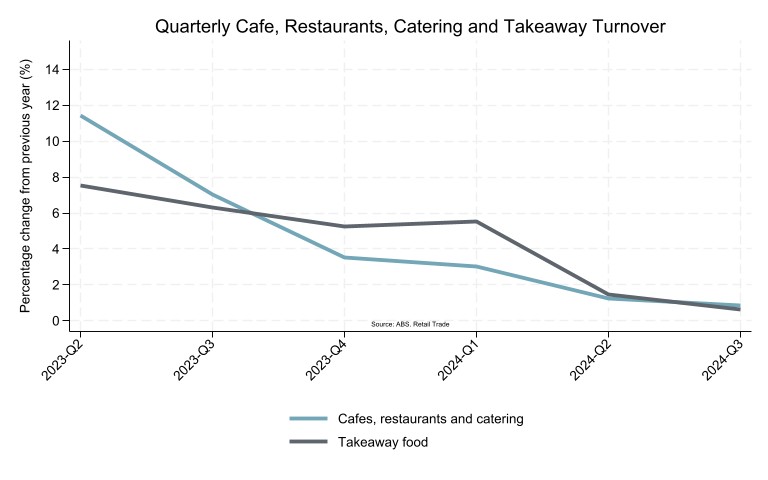

Out-of-home dining and takeaway spending seem to have plateaued in the third quarter, with modest year-on-year growth of 0.8 and 0.6% respectively, compared to the previous year.

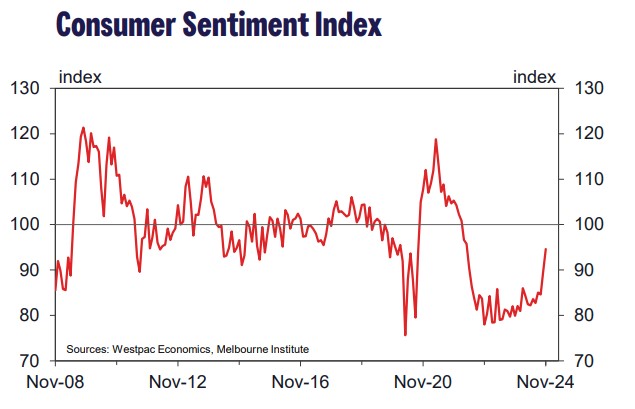

The latest Westpac-Melbourne Institute Consumer Sentiment Index rose to 94.6 in November, marking a 14.4% increase from its mid-year lows.

Families are feeling some relief in their finances thanks to tax cuts, fiscal support, and stable interest rates. With no expectation of further interest rate hikes, consumer confidence in the economic outlook is growing.

While the index showed some fluctuations following the US elections, reflecting uncertainty from geopolitical developments, sentiment is improving. This is a positive sign for retailers heading into the Christmas season.

For the first time since Christmas during the pandemic recovery, the 12-month economic outlook shows cautious optimism.

The figures presented are current at the time of publication and are subject to updates and revisions.

Content suggestions can be emailed to Samuel Garcia – samuel.garcia@afgc.org.au.

If you would like others within your business to receive the Economic Bulletin, please contact us at afgc@afgc.org.au or update your subscriptions in the Member Centre.