Topic/Category

Year

Topic/Category

Year

26 March 2025

The 2025-26 Federal Budget presented by the Federal Treasurer, the Hon Dr Jim Chalmers MP, acknowledges economic challenges but remains cautiously optimistic in the dawn of an election. Inflation has moderated, growth picked up at the end of last year, and the labour market has remained strong, with real wages starting to rise. However global uncertainty, trade tensions and natural disasters continue to pose risks to the economy.

Cost-of-living relief is a key focus in this year’s budget, with personal income tax cuts, extended energy bill support, cheaper medicines and increased bulk billing incentives. It also expands subsidised early childhood education and includes plans to build 1.2 million new homes, invest in social housing, and support renters.

To drive growth, the budget includes additional support for competition reforms, support for small businesses, and investments in green manufacturing through the “Future Made in Australia” program. Infrastructure investment remains a priority to strengthen the economy. While challenges remain, the government believes that Australia is in a strong position to manage economic uncertainties.

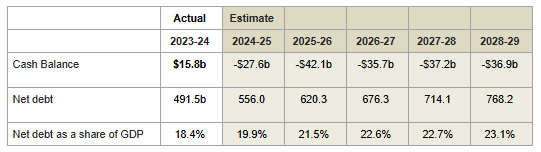

The budget forecasts a $27.6 billion deficit in 2024-25 rising to $42.1 billion in 2025-26. Gross debt is set to peak at 37% of GDP in 2029–30 before declining to 31.9 % by 2035–36. The government has returned 69% of tax receipt upgrades to the budget, down from 87% in 2023-24, aiming to reduce future interest payments.

Key fiscal measures in the budget include new personal income tax cuts in 2026 and 2027. Tax cuts introduced since 2024 are expected to increase household disposable income by 1.9% by 2027–28.

Table 1- Key Budget Parameters

Source: 2025-26 Budget Paper 1, Table 3.1: Australian Government general government sector budget aggregates

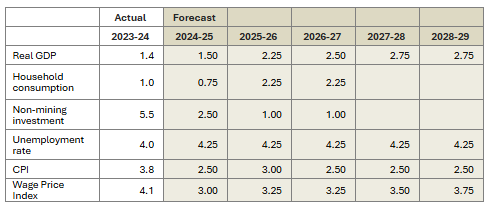

Inflation is moderating without stalling growth, unemployment remains low and real wages are rising. Interest rates have started to fall, and economic growth rebounded at the end of last year, with momentum expected to improve. However, global uncertainty remains high due to trade tensions, conflicts in the Middle East and Europe, and challenges in China. Trade disruptions, tariffs, and market volatility could impact global and domestic economic activity, investment, and prices. Weather-related events, like ex-Tropical Cyclone Alfred, have also affected industries, infrastructure, and growth.

Despite these risks, government is optimistic that the economy is on track with household incomes, employment growth and lower inflation boosting consumption. Real household disposable income is forecast to be nearly 8.75% higher by 2026–27 compared to 2023–24.

Export growth is expected to slow, particularly in services and non-rural commodities, while infrastructure spending will support demand for imports.

Table 2 – Economic Outlook

Source: 2025-26 Budget Paper 1, Table 1.1 Major economic parameters and Table 2.2 Domestic Economy – detailed forecasts

Consumer

Competition

Energy

Industry

Supply chain and infrastructure

Jobs and Labour

Biosecurity

Environment

Trade

Click here to see the AFGC’s media release >>

For more information contact the AFGC Industry Affairs team at afgc@afgc.org.au.

Shalini Valecha

Director – Industry Affairs